Court sets late Feb. deadline for certified questions in Tinian stablecoin case

The legal challenge to Tinian’s proposed government-backed stablecoin remains stayed, with the Superior Court tasking the CNMI Office of the Attorney General with preparing and filing certified questions for possible referral to the Supreme Court by the end of February.

Associate Judge Kenneth L. Govendo set the deadline after hearing arguments from the parties last Jan. 26 in Superior Court, citing prolonged delays linked to changes in legal representation and the ongoing preparation of a stipulated statement of facts.

Chief solicitor J. Robert Glass Jr., appearing for the Office of the Attorney General, told the court the OAG is still working on the certified question and coordinating with Senate legal counsel Antonette Villagomez, who has replaced Joey Patrick San Nicolas as counsel for the Tinian delegation. Glass said the government does not oppose a court-imposed deadline and is prepared to litigate the matter if necessary.

The court was also informed that, for purposes of the certified question, Sen. Jude U. Hofschneider will serve as head of the Tinian delegation, replacing Tinian Mayor Edwin P. Aldan as the proper party to represent the delegation before the Supreme Court.

Counsel for Marianas Rai Corp., Richard Miller, urged the court not to allow further delay, arguing that the certified question should be ready after months of discussions among the parties. Miller said Marianas Rai Corp. does not oppose a deadline but objected to extending it into late March.

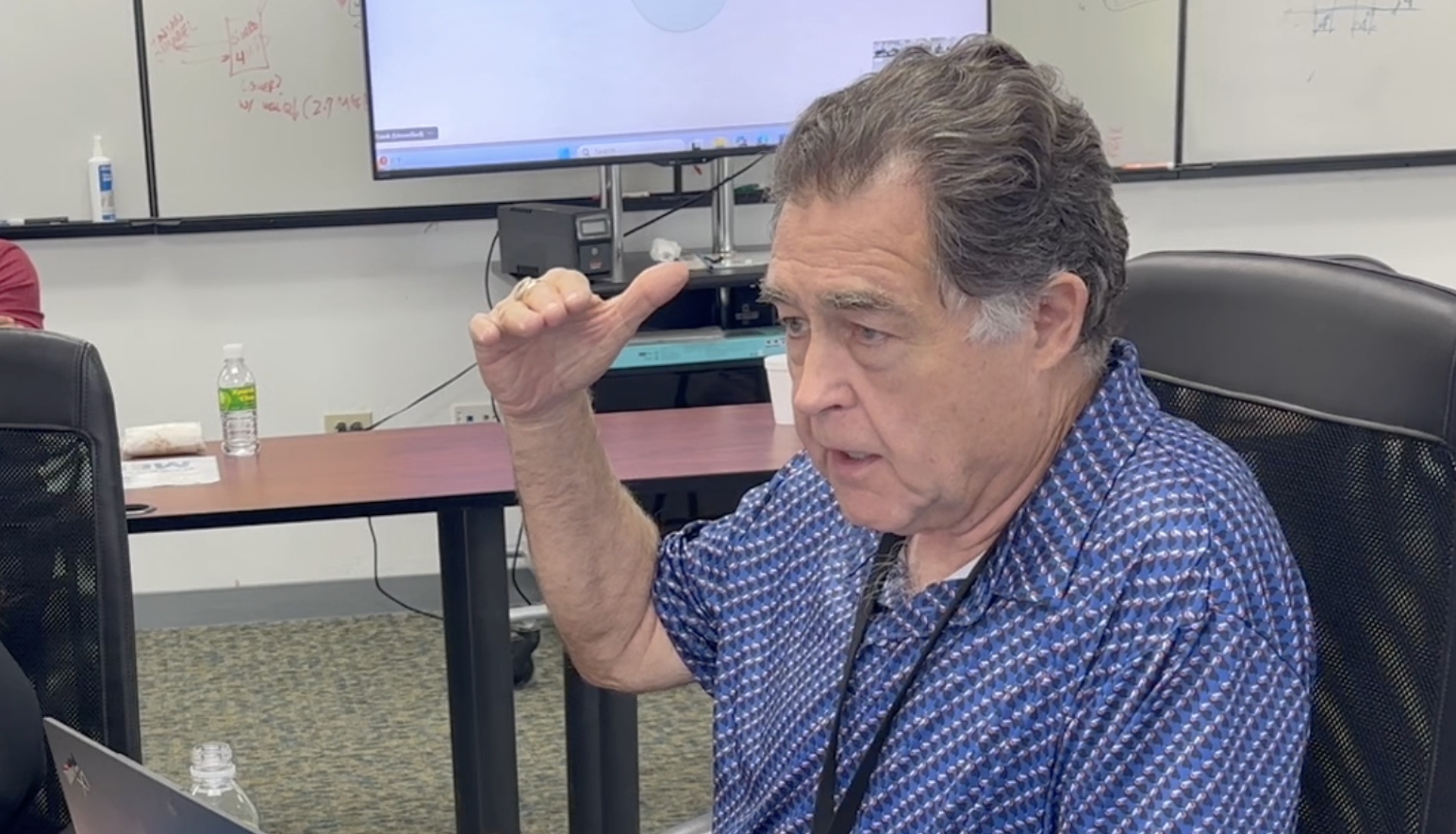

Following the hearing, Marianas Rai Corp. principal Vin Armani welcomed the court’s decision to impose a deadline.

“It’s gone on a long time,” Armani said. “We haven’t seen a reason why it should take this long to come up with a statement of facts. The Attorney General had to have a statement of facts to file the case in the first place.”

Armani said the uncertainty surrounding the litigation has hurt the company’s ability to engage investors and partners.

“When you have this sort of risk added, especially coming to a place they’ve never heard of before, it makes it very difficult,” he said. “The sooner we can get this settled, the better.”

Armani said the certified question goes to the heart of whether the Tinian law authorizing the Marianas U.S. Dollar stablecoin is constitutional.

“The law is in force. It’s active,” he said. “But we have a stipulated injunction that’s stopping everybody from doing work until this is settled. Let’s put it in front of the court and let them decide.”

The case remains stayed pending the filing of the certified question by the Attorney General’s Office.

Share this article