Rev & Tax unable to project CNMI construction tax revenues

Revenue & Taxation director Daniel Dean T. Alvarez Jr. acknowledged that his division is currently unable to project construction tax revenues because it lacks complete information on construction contracts, payment schedules, and project timelines.

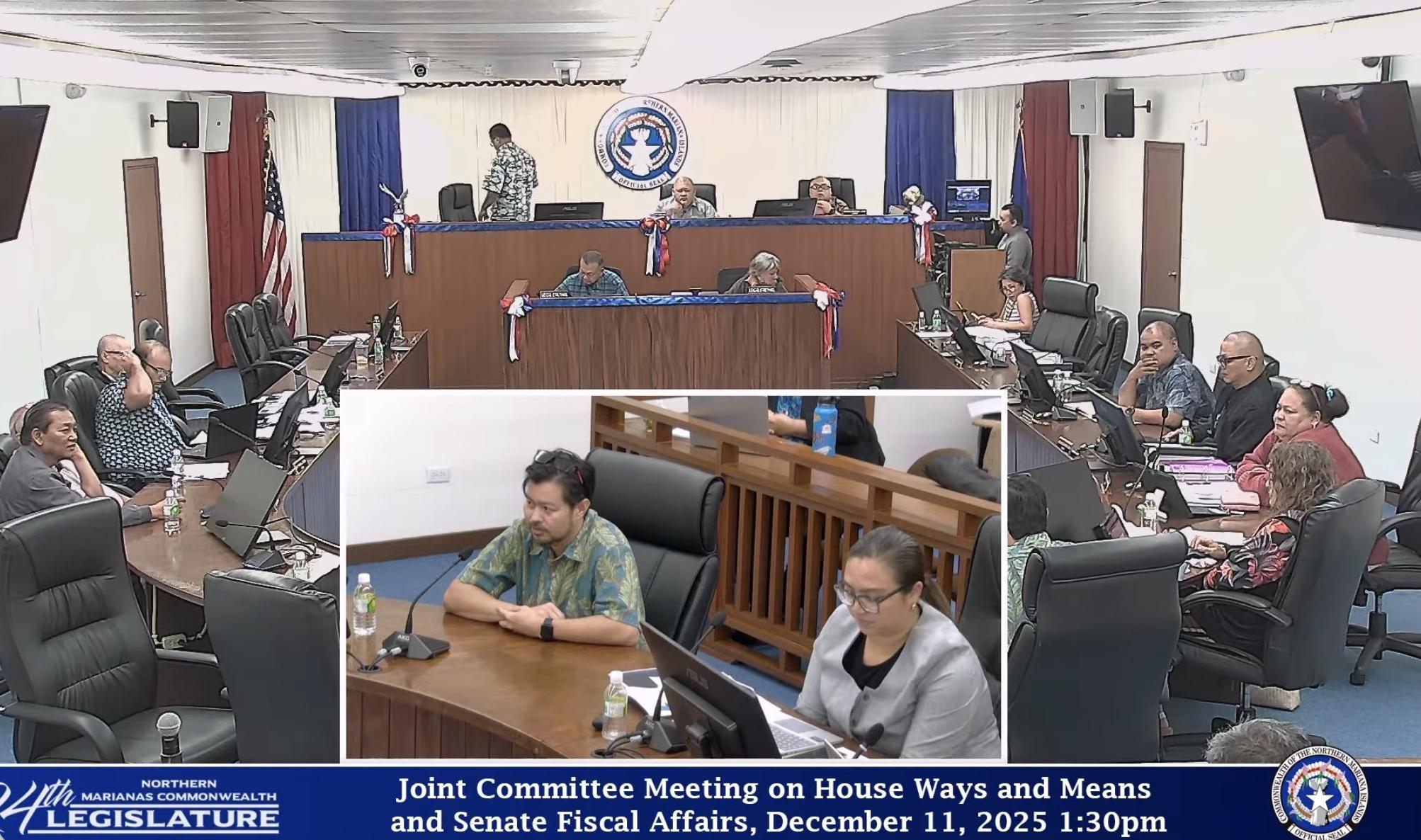

“I can't say what we're predicting or projecting as far as construction tax collections go. I don't have all the information on the contracts and the payment methods, payment terms, when they're going to receive payments, and when the taxes are supposed to be paid. So I can't predict what the revenue would look like from collecting construction taxes,” Alvarez said at the Dec. 11 joint meeting of the House Ways and Means Committee and the Senate Fiscal Affairs Committee at the Capitol.

Alvarez added that under the CNMI’s tax structure, construction companies are required to self-report their projects and related details.

“The construction companies would have to report what their project is, the timeline, and the cost on these tax returns. So that's how we're going to acquire the information. We can get other information from third-party sources, such as other agencies, but for the most part, it's going to be voluntary,” he said.

Finance Secretary Tracy Norita came to Alvarez’s defense after House Ways and Means chair Rep. John Paul Sablan challenged the characterization of the process as “voluntary,” stressing that reporting is mandated by statute.

“I think it's worth noting that our entire tax structure is built on a framework of voluntary compliance. That is how all taxpayers report to the Division of Revenue & Taxation. That is how we collect taxes—an individual filing their 1040, a business filing their BGRT. They voluntarily report their revenues and pay their taxes according to the tax law. And if they don't, that's where enforcement kicks in. We can't go to a business and force them to file something they don't have,” Norita said.

Rep. Marissa Flores argued that the Department of Finance already has access to extensive business and tax identification information and should be able to cross-check contractors and subcontractors involved in major projects. She urged Finance to be more proactive, pointing to the scale of ongoing construction activity and the Legislature’s expectation that revenue-generating laws actually produce revenue.

Norita acknowledged the concern and said outreach efforts have been conducted, but reiterated that the construction tax is new and its collection mechanisms are still being operationalized.

“Every taxpayer is entitled to notice of their balances and tax obligations. They are given a timeline to respond, and we have to follow that process for collection. It's not as easy as having a list of contractors and showing up at their front door and saying, ‘Hey, you owe this.’ They have rights, and we must serve a notice of collection. I think many people understand what we’re talking about because thousands of letters have gone out,” she said.

The exchange ended with the joint House and Senate panel pressing Finance to improve coordination and enforcement to ensure the construction tax generates revenue as intended, particularly amid heightened construction activity funded by the U.S. Economic Development Administration, Community Development Block Grant–Disaster Recovery, and other sources.

Share this article